Is now a good time to buy a home in Nashville, or should you wait for the market to change?

If you’ve been asking yourself this question, you’re not alone. With headlines constantly shifting and interest rates fluctuating, many potential homebuyers in Nashville are wondering whether to jump into the market now or try to "time" the perfect moment. As an experienced Realtor and real estate agent serving the Middle Tennessee area, I’m here to tell you: time in the market beats timing the market—especially when it comes to buying a home.

Why This Philosophy Matters in Real Estate

The idea that "time in the market beats timing the market" is a fundamental principle more commonly associated with investing, but it applies just as strongly to real estate. The key takeaway? It’s not about trying to buy at the absolute lowest price or the perfect interest rate. It’s about owning real estate for the long term and letting the market work in your favor over time.

Real estate, particularly in a growing metro like Nashville, historically appreciates over the long run. Homeownership also offers stability, tax benefits (consult a tax professional for more details), and a pathway to building equity that renting simply cannot provide.

The Risks of Waiting for the "Perfect Time"

Trying to time the real estate market is like trying to predict the weather months in advance. It’s tempting to wait for prices to drop or interest rates to fall, but the reality is:

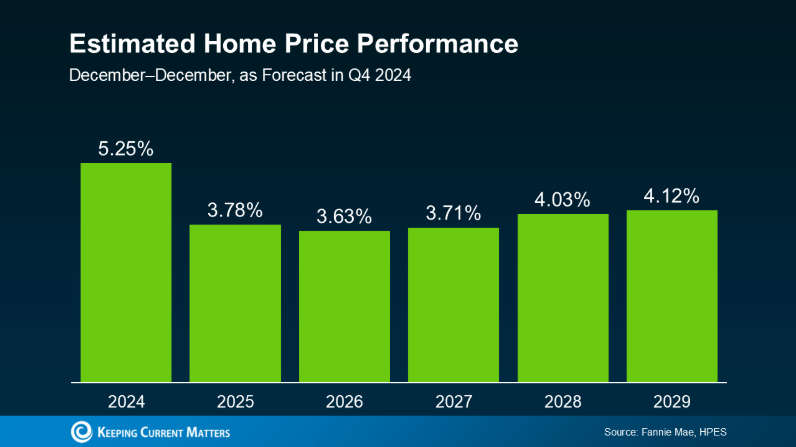

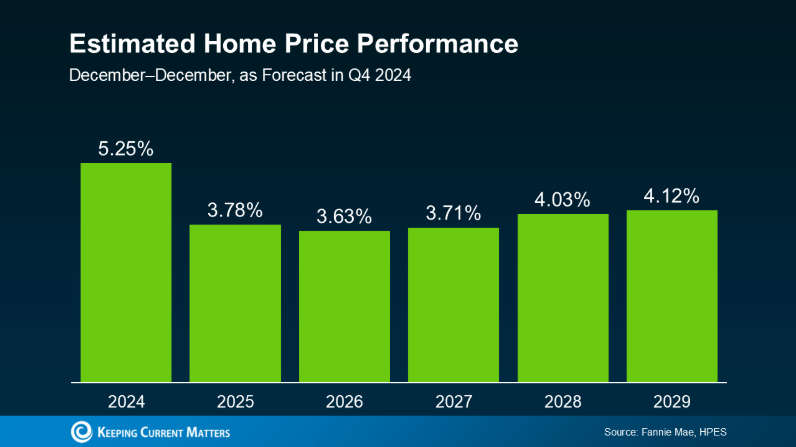

In the latest HPES, experts project that home prices will continue to rise through at least 2029, just at a slower and more sustainable pace compared to the rapid appreciation we saw in recent years. That’s still good news for buyers—because it means homes are expected to keep gaining value.

But what does that really mean for you as a buyer in Nashville?

Let’s use a practical example: say you buy a $400,000 home this January. Based on HPES expert forecasts, you could gain more than $83,000 in household wealth over the next five years. That’s a significant amount of equity—equity you’re missing out on every month you continue to rent.

In the latest HPES, experts project that home prices will continue to rise through at least 2029, just at a slower and more sustainable pace compared to the rapid appreciation we saw in recent years. That’s still good news for buyers—because it means homes are expected to keep gaining value.

But what does that really mean for you as a buyer in Nashville?

Let’s use a practical example: say you buy a $400,000 home this January. Based on HPES expert forecasts, you could gain more than $83,000 in household wealth over the next five years. That’s a significant amount of equity—equity you’re missing out on every month you continue to rent.

In a city like Nashville, where demand is steady and long-term growth is projected, getting into the market sooner rather than later could be your smartest financial move.

Tips for Buyers in Today’s Market

As your trusted Nashville real estate agent, here are my top tips for buying with a long-term mindset:

In a city like Nashville, where demand is steady and long-term growth is projected, getting into the market sooner rather than later could be your smartest financial move.

Tips for Buyers in Today’s Market

As your trusted Nashville real estate agent, here are my top tips for buying with a long-term mindset:

- You could end up paying more later if home values continue to rise, which they’ve consistently done in the Nashville area.

- Interest rates may not drop significantly, and even if they do, increased competition could drive up prices.

- You miss out on building equity, which can be a powerful wealth-building tool over time.

- Nashville's growth trajectory is strong, with continued job creation and infrastructure improvements

- You start building equity sooner, which opens doors to future investment opportunities

- Tax benefits of homeownership (always consult a tax advisor)

- Stability for your family, lifestyle, and finances

- Potential to refinance later if interest rates drop, but you can’t go back in time and buy at today’s home prices

In the latest HPES, experts project that home prices will continue to rise through at least 2029, just at a slower and more sustainable pace compared to the rapid appreciation we saw in recent years. That’s still good news for buyers—because it means homes are expected to keep gaining value.

But what does that really mean for you as a buyer in Nashville?

Let’s use a practical example: say you buy a $400,000 home this January. Based on HPES expert forecasts, you could gain more than $83,000 in household wealth over the next five years. That’s a significant amount of equity—equity you’re missing out on every month you continue to rent.

In the latest HPES, experts project that home prices will continue to rise through at least 2029, just at a slower and more sustainable pace compared to the rapid appreciation we saw in recent years. That’s still good news for buyers—because it means homes are expected to keep gaining value.

But what does that really mean for you as a buyer in Nashville?

Let’s use a practical example: say you buy a $400,000 home this January. Based on HPES expert forecasts, you could gain more than $83,000 in household wealth over the next five years. That’s a significant amount of equity—equity you’re missing out on every month you continue to rent.

In a city like Nashville, where demand is steady and long-term growth is projected, getting into the market sooner rather than later could be your smartest financial move.

Tips for Buyers in Today’s Market

As your trusted Nashville real estate agent, here are my top tips for buying with a long-term mindset:

In a city like Nashville, where demand is steady and long-term growth is projected, getting into the market sooner rather than later could be your smartest financial move.

Tips for Buyers in Today’s Market

As your trusted Nashville real estate agent, here are my top tips for buying with a long-term mindset:

- Define your why – Understand what’s motivating your move. Lifestyle goals often outweigh market conditions.

- Get pre-approved – Know what you can afford and shop with confidence.

- Focus on the right home, not the perfect deal – A home that fits your needs is a better investment than waiting for the “perfect” price.

- Partner with a local expert – Work with a Nashville Realtor like Roger Bradley who understands the market and advocates for your best interests.