The decision to purchase a home is one of the most significant financial steps you'll take in your

lifetime. While the current housing market might feel uncertain, there's one factor that remains

consistent: homeownership is one of the most reliable paths to building long-term wealth. If

you're weighing the decision to buy a home, consider the financial security, wealth generation,

and stability that come with owning your own property.

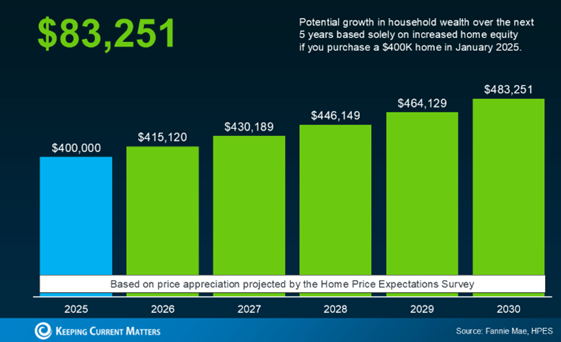

The $83,000 Opportunity: Understanding Home Appreciation

For many prospective buyers, hesitation to purchase stems from concerns about today’s

mortgage rates. However, focusing too much on current rates can obscure the bigger picture: the

incredible opportunity to build wealth through home equity. According to a recent Home Price

Expectations Survey (HPES), a $400,000 home purchased in January 2025 is projected to

appreciate to over $483,000 by 2030. That’s an increase of $83,000 in just five years.

Think about it this way: most Americans will never see an $83,000 raise in their careers, but with

homeownership, you can achieve that level of wealth without extra work, side hustles, or

promotions. This wealth accumulation comes solely from the appreciation of your home’s value

over time. That’s $16,600 per year in equity gains—all while living in a home you love.

Why Time in the Market Beats Timing the Market

Trying to time the real estate market to find the “perfect” moment to buy can feel overwhelming

and unpredictable. As Bankrate puts it, “No matter which way the real estate market is leaning,

buying now means you can start building equity immediately.” Historically, real estate values

have always trended upward over the long term, even during periods of short-term market

fluctuations.

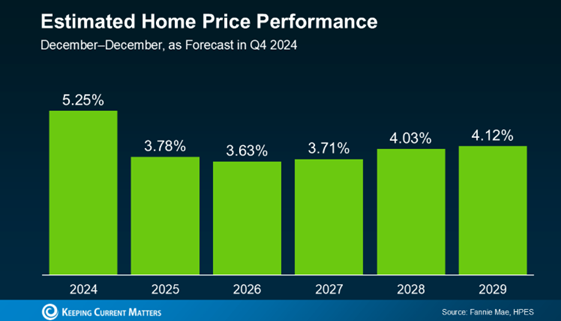

Data from experts supports this. Each quarter, Fannie Mae’s HPES surveys over 100 economists,

real estate experts, and market strategists. Their latest forecast shows that home prices are

expected to rise steadily through 2029, albeit at a more moderate and sustainable pace compared

to the past few years. This consistent growth underscores why time in the market is a better

strategy than trying to time the market.

Why Renters Lose Out on Equity Gains

If you’re renting, you’re paying to build someone else’s wealth instead of your own. Monthly

rent payments essentially contribute to your landlord’s equity in their property. On the other

hand, when you own a home, your monthly mortgage payments go toward building your own

equity.

Consider this: as home prices appreciate, your home’s value increases, but your mortgage

payment remains fixed. In contrast, rents typically rise over time, leaving you with higher costs

and no financial return. By purchasing a home, you lock in stable housing costs and position

yourself to benefit from the wealth-generating effects of appreciation.

The Compounding Effect of Home Appreciation

While annual home appreciation rates might seem modest, their compounding effect over time

can lead to substantial wealth growth. Here’s a breakdown of the projected home appreciation

rates from 2024 to 2029:

These incremental gains may seem small, but over five years, they add up significantly. Using

the example of a $400,000 home, these appreciation rates result in a $83,251 increase in equity.

This is the power of compounding: even small annual increases grow into substantial gains over

time.

Why Waiting Could Cost You

While it might be tempting to wait for the market to change or for interest rates to drop, delaying

your home purchase could mean missing out on significant equity gains. For example, if you

wait a year to buy that $400,000 home, you could lose out on nearly $15,120 in potential equity

growth. Over five years, that missed opportunity compounds, leaving you further behind in your

wealth-building journey.

Moreover, as home prices continue to rise, the cost of entry into the market increases. By buying

now you not only lock in today’s prices but also position yourself to benefit from future

appreciation. The sooner you start building equity, the more financial security you’ll have in the

long run.

Call to Action: Start Building Wealth Today

Don’t let hesitation keep you from achieving your homeownership dreams. Take the first step

toward building wealth and securing your financial future, and contact me today to learn more

about available properties, creative financing options, and strategies to secure your dream home

here in Middle TN.

Call me at (615) 417-3373 or visit www.rogerbradleyre.com to get started.