As the real estate market continues to evolve, one of the most pressing questions for homebuyers and sellers alike is, “Are mortgage rates going to go down in 2025?” This year has already seen volatility, and forecasts suggest we might see some stabilization by year-end. In this blog, we’ll break down expert opinions, key market factors, and data to help you better understand what to expect in the coming months.

What Experts Are Saying About Mortgage Rates in 2025

The Forecasts:

Mortgage rates have fluctuated significantly over the past two years, reaching an average of 7.17% as the 2nd week of Jan 2025. According to Greg McBride, Chief Financial Analyst at Bankrate, “It’s impossible to predict where rates will land precisely, but there is consensus that they’ll likely be lower by the end of 2025 than at the start of the year, albeit with some volatility in between.”

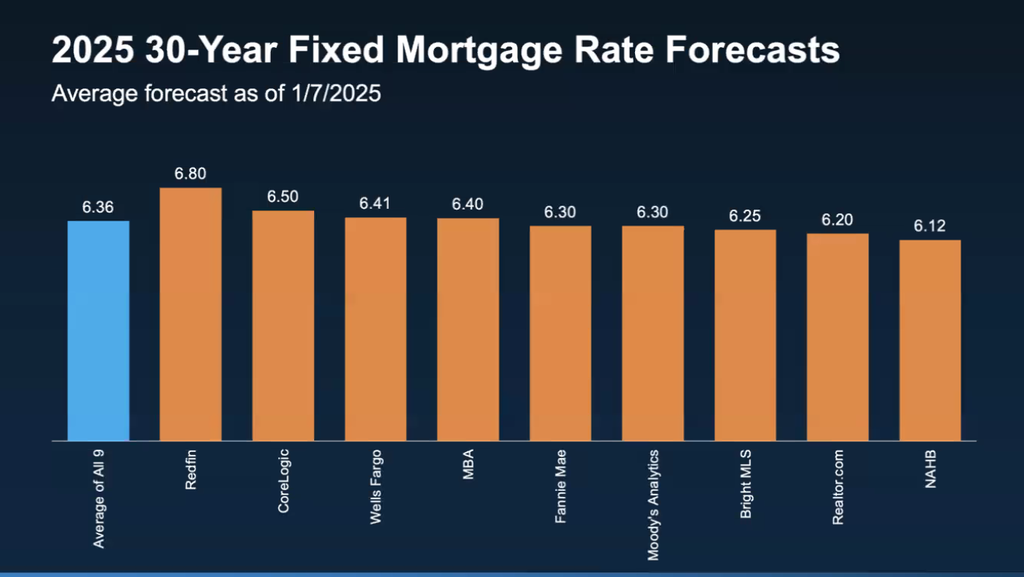

Here are the projections from nine major organizations:

The majority forecast rates to settle between 6% and 6.5% by the end of the year. This represents a healthier, more stable range compared to the peaks seen in recent years.

Key Takeaways:

- Rates could end the year in the low 6% range.

- External factors like inflation data and job market performance will influence trends.

- Significant fluctuations are still expected, meaning timing will be crucial for buyers and sellers.

How Mortgage Rate Trends Impact the Housing Market

A Balanced Market in 2025?

According to McBride, most areas will lean toward a seller’s market due to limited inventory, but certain regions could see a shift toward balance or even a buyer’s market. Areas with increased inventory, such as Austin, TX, and Boise, ID, might experience mild price declines, while most of the country enjoys moderate price growth. Wilson County, and the Nashville area remain just slightly toward the seller’s advantage with slight price growth.

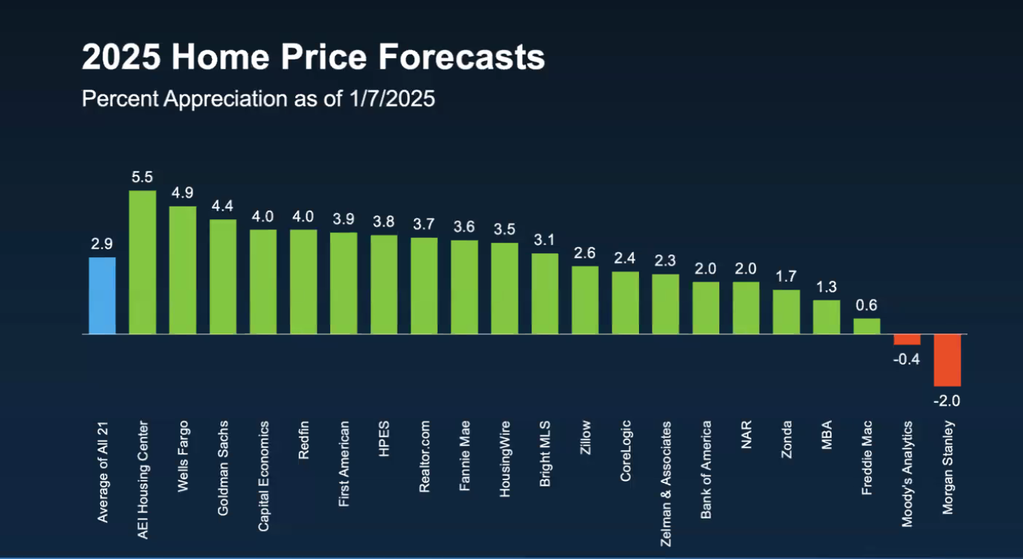

This aligns with expert consensus that home prices throughout 2025 will appreciate at a healthy pace of around 3% this year:

Historically, this level of appreciation is considered normal and sustainable, helping to foster a healthier market overall.

Mortgage Rates and Buyer Activity

High mortgage rates in 2024 forced many prospective buyers to pause their home searches. However, as rates begin to dip as we go through 2025, expect some of these buyers to re-enter the market. McBride notes that “waiting for lower rates is not guaranteed,” and as rates settle, buyer activity is expected to increase, further driving market momentum and home prices up.

The Long-Term Perspective on Mortgage Rates

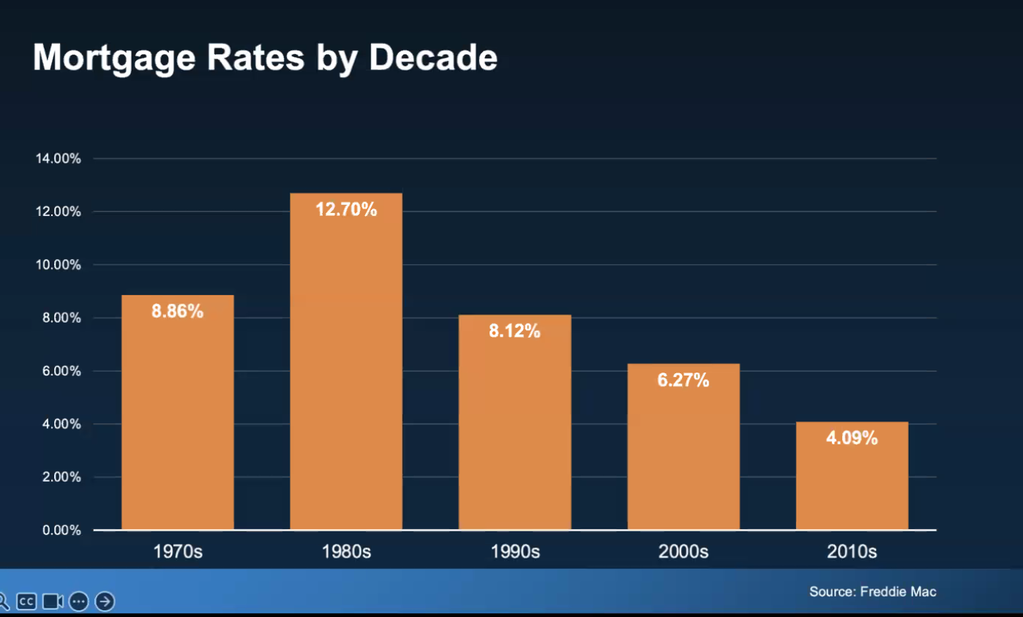

Taking a wider view, it’s helpful to compare current rates to historical averages. Here’s a look at mortgage rates by decade:

While current rates remain higher than the 2010s average of 4.09%, they are far below the double-digit rates seen in the 1980s. This perspective helps buyers and sellers understand that today’s rates are not historically unprecedented, even if they feel high compared to recent years. My first home mortgage in 1987 came with a rate of 11%, and I was thrilled to get it.

Key Insights for Homebuyers and Sellers in 2025

For Buyers:

- Opportunity in Volatility: Use periods of rate dips to lock in favorable terms, but don’t try to time the market, that rarely works in your favor. Consult with your lender to stay informed about rate changes.

- Focus on the Long Term: Even at slightly higher rates, investing in a home can be a smart financial decision when prices are stable or appreciating. If you find the perfect home, and you can afford it, that’s the time to act.

For Sellers:

- Leverage Limited Inventory: With inventory expected to grow modestly (around 10%), sellers who price competitively can still attract motivated buyers. Pricing your home based on wishful thinking rather than market reality can lead to a longer time on the market and ultimately a lower final sale price.

- Be Prepared for a Balanced Market: Collaborate with a knowledgeable real estate agent to navigate shifting dynamics and position your home effectively.

Conclusion: What Does 2025 Hold?

While no one can predict the future with certainty, the path for mortgage rates in 2025 seems clearer. Experts agree that rates are likely to end the year lower than they started, settling in the low to mid-6% range. For buyers and sellers in Nashville and Middle TN, this presents a unique opportunity to act strategically in a market poised for stabilization.

If you’re considering buying or selling a home in Nashville, Wilson County, or the surrounding areas, contact me for expert guidance. With my market expertise and personalized approach, I am here to help you make the most informed decisions for your real estate goals.